- Home

- Encyclopedia

- The Mineral Leasing Act of 1920: The Law That C...

The Mineral Leasing Act of 1920: The law that changed Wyoming’s economic destiny

In 1922, Wyoming State Geologist Albert Barlett had the temerity to say that the mineral industry was more important to the state economy than either livestock or agriculture.

A number of events might have moved Bartlett to draw such a heretical conclusion. For starters, agriculture was having a tough time due to smoking hot weather and post-World War I deflation. Most importantly, crop, beef, lamb and wool prices had all plummeted after the war. In Fremont County, for example, one of the state’s leading agricultural counties, total crop values fell from $2.4 million in 1919 to less than $900,000 in 1924. Wyoming farmers, ranchers, their bankers and the small towns where they did business were all hit hard by this statewide agricultural depression.

But while the price of oil also dropped after the war, it soon steadied at between $1.00 and $1.50 per barrel until 1930. National demand for oil remained high in the 1920s as people bought more gasoline-burning cars and governments built better roads. The booming Salt Creek Oil Field in northern Natrona County, Wyo. for example, reached its all-time peak annual production of 3.5 million barrels in 1923.

But perhaps the most interesting part of the economic mix Bartlett was talking about were the effects of a new law passed by Congress—the Mineral Leasing Act of 1920. And the new law came about because of a dispute that started in the Salt Creek Oil Field, in central Wyoming.

In the long run, the provisions of this law have contributed enormously to Wyoming’s wealth and to the revenues of its state government—helping, as Bartlett said, to make the mineral industry the state’s most important, and to keep it there.

The old 1872 Mining Law allowed companies that extracted any minerals from public land in the West to pay a very low fee for the privilege and, soon, to own the land outright and all the minerals—and profits—that came from it.

The new, 1920 law divided the legal status of oil, natural gas, coal and phosphates from the so-called hard rock minerals like gold, silver, copper and lead minerals, and established a new leasing system that continues today. Companies pay up-front fees when they first lease a piece of federal land with, say, oil or coal on it. Then they pay the government a royalty of one-eighth of the revenue they get from sale of the mineral produced from the land.

The government, in turn, pays half that royalty back to the states from which the mineral was extracted. Wyoming’s finances do extremely well by this system; In fiscal year 2011 alone, for example, federal mineral royalties paid to Wyoming added up to $948 million, half of all the total federal mineral royalty distribution in the U.S. This was enough to finance about 12 percent of the state of Wyoming’s general-fund budget that year.

How this all came about makes for a story that connects Wyoming’s rough-and-tumble oil fields of the early 20th century with the highest levels of national politics.

Wyoming oil and a president’s authority

In the first decade of the 20th Century, the U.S. Navy began retrofitting its warships to run on fuel oil instead of coal. At the same time, demand for oil rose as more and more people bought gasoline-fueled automobiles.

In 1909, the chief of the U.S. Geological Survey advised the Secretary of the Interior that oil companies in California were claiming oil prospects so fast—and at such low fees—under the 1872 Mining Law that soon “the government will be obliged to repurchase the very oil” to run its Navy “that [previously] it has practically given away.”

Primarily to protect the Navy’s fuel supply, President William Howard Taft issued an order withdrawing more than 3 million acres of public land in California and Wyoming—land with good oil prospects on it—from availability to oil producers.

But he was unsure of his constitutional authority to do this, and asked Congress to pass a law giving him the authority. Congress did this; it passed the Pickett Act in 1911—but that law did not make the president’s new authority retroactive to the withdrawals he had ordered in 1909.

Meanwhile, oil prospectors doing business with the Midwest Oil Company, which had large holdings in the Salt Creek Field, filed a mineral claim on a 160-acre tract in the field that was included in the land that President Taft had withdrawn. They drilled, and hit oil, and the company pumped 50,000 barrels of oil out of the ground.

When it found out what had happened, the U.S. attorney’s office in Cheyenne sued the company for recovery of the tract and for the value of the oil the company had already extracted.

United States v. Midwest Oil, as the case was called, made its way all the way to the U.S. Supreme Court.

A divided court

At stake in the case was a president’s constitutional right to use the executive order to withdraw oil-producing land from further claims by companies.

Politics of the era were deeply divided, with progressives and conservatives in constant conflict.

So was the court.

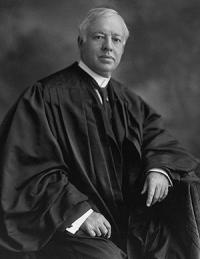

At the time, such luminaries on the court as Oliver Wendell Homes (“the U.S. Constitution is an experiment, as all life is an experiment”) clashed with fellow Associate Justice Willis Van Devanter, a conservative who had served in Wyoming’s territorial legislature and as chief justice on the territorial supreme court, before returning to his law practice after statehood in 1890. Taft had named Van Devanter to the U.S. Supreme Court in 1910.

Associate Justice Joseph Lamar eventually wrote the decision, but only after the court heard the case for the second time. The first time around, one judge was absent and only eight justices heard the arguments. They deadlocked 4-4 and ordered a complete rearguing of the case. Before Lamar wrote his ruling after the second round of arguments, a heart attack felled associate Justice Horace Lurton while he vacationed in Atlantic City. His replacement, James McReynolds, declined to weigh in on the Midwest matter, so once again it was an eight-man court.

In the final ruling in 1915, the court divided 5-3, affirming a lower court decision upholding Taft’s right to do what he had done. Van Devanter was among the dissenters.

While the constitutionality of Taft’s right to withdraw oil-producing land was center stage, the case highlighted the problem under the old law of issuing patents—essentially deeds to the mineral lands—which were considered a form of absolute property, on oil discoveries.

The federal government now saw petroleum as rare, valuable, and vital to the public interest. Congress therefore tossed out the patenting process and decided that oil leases on federal land, given in ten-year increments, gave the government, which owned the land, more control over production.

On February 25, 1920, President Woodrow Wilson signed the Mineral Leasing Act of 1920.

A New Era

The new law made exploring for and extracting oil and gas on federal land a privilege, not a right. The act, “converted the United States into a very large proprietor of producing petroleum lands,” wrote Harold Robert in his book, Salt Creek, Wyoming: the Story of a Great Oil Field.

While wanting to encourage production, Congress was also mindful of the problems associated with oil monopoly, even with the new leasing system in place. Congress therefore wrote the new law in some of the same trust-busting spirit in which, with the backing of the Supreme Court, it had broken up the monopoly of the huge Standard Oil trust in 1911.

The Mineral Leasing Act forbade any person or corporation from owning more than three oil and gas leases in any one state and more than one lease in any given oil field. The limitations eventually were broadened until they reached the current maximum: No entity can lease more than 246,080 acres of federal oil and gas land in any one state at the same time.

There was also the matter of money. Not only did oil leasing bring a steam of revenue to the federal government but, for the first time, states got a piece of the action.

“Before the Mineral Leasing Act, all federal minerals (except coal) were produced under the Mining law of 1872, which imposed no rent or royalty. Uncle Sam gave away the minerals for free, so there was no federal revenue to share with the states,” wrote John Leshy, of the University of California’s Hastings College of Law.

While energy companies licked their wounds, having lost the right to patent and thus own outright formerly federal land with minerals under it, state treasurers rejoiced. The Mineral Leasing Act gave states a 37.5 percent royalty of the receipts of any coal mine or oil and gas well developed on federal land within its borders. Five decades later,that share would expand to a full 50 percent, a figure that would hold until 2007, when the federal government reduced the share to 48 percent.

Corporations, trying to bolster their image as good citizens, pointed out the advantage of these new revenues to the states. “When the oil leasing bill becomes law, all schools and the state university will receive greatly increased funds both from the oil now impounded by the United States government and from the future production which will be greatly increased by the development of all oil fields under encouraging national legislation,” said T.A. Palley, tax commissioner of the Midwest Refining Company.

Much-needed cash

The royalties arrived in state coffers just in time. Except for occasional spikes, prices on farm products remained grimly low.

The Mineral Leasing Act helped push the values of oil, gas, and coal in Wyoming beyond the values of agriculture. In 1919, cattle alone were valued at $42 million. By 1925, cattle and sheep valuation combined had fallen to $26 million. The same year, oil, gas and coal valuations reached $60 million.

By 1921, Standard Oil was shipping gasoline refined in Casper, 40 miles south of the Salt Creek Field, by tank car to Louisiana where it was piped into tankers bound for Europe.

Wyoming lost little time deciding what to do with the oil money. The legislature in 1921 created something Wyoming had never had before: a “Government Royalty Fund.” Using this kitty as a distribution vehicle, the state gave 2 percent of the first $2 million in annual royalties back to the county where production originated, 38 percent to the state highway commission, 50 percent to teachers’ pay and 10 percent to the University of Wyoming for capital construction projects.

Any amount received over $2 million per year was socked away in the Common School Fund and a State Highway Permanent Maintenance Fund.

The first year after the passage of the act Wyoming received $748,445 in federal royalties. The number of zeros on the checks from Washington continued to grow until 1924, when the state received $4.2 million in royalties. Wyoming government the time cost only about $1.2 million per year to run, so the royalty revenues in 1924 could have kept the state going for three and a half years, according to figures from Wyoming historian, T.A. Larson.

Still the Cowboy State

Yet Wyoming continued to remain, at least in image, a cowboy state. Why?

Monopoly again became part of the discussion when a 1921 Federal Trade Commission Report documented that Standard Oil of Indiana controlled upwards of 97 percent of Wyoming’s petroleum production and enjoyed a 33 percent return on investment.

In 1922, the oil and gas industry fell into further disrepute after revelations of monopoly and price gouging, and in the wake of the Teapot Dome scandal, in which it was revealed that the U.S. secretary of Interior and others had taken bribes from oil men.

Finally, not even oil and gas could save the state. As the Great Depression gathered strength after the stock market crash of 1929, assessed valuation on minerals plummeted along with every other commodity. By 1934, when production had fallen to about a fourth of what it had been in 1923, Wyoming’s mineral valuation totaled only $6 million.

But after World War II mineral royalties paid annually to Wyoming began to climb again. In 1951 they again shot past the $4 million mark. By 1980, they exceeded $115 million. In fiscal year 2011, federal royalties to Wyoming added up to $948 million, half of all the total federal mineral royalty distribution in the U.S. That was enough to pay for about 12 percent of the state’s $8 billion budget for the same year.

Two factors have contributed to this spectacular increase. First, the majority of all coal mined in the Powder River Basin, the world’s largest coal production region, comes from federal mineral leases.

The second reason for the increase was savvy politics, when in 1976 Wyoming’s congressional representatives were able to alter the Mineral Act of 1920 to the state’s advantage. That year, Democrat Representative Teno Roncalio and Republican Senator Cliff Hansen persuaded Congress to amend the Mineral Leasing Act by boosting states’ share of mineral royalties from 37.5 percent to 50 percent.

While the amendment helped out New Mexico, Colorado, and Alaska, none stood more to gain from the increase than the state where it all started: Wyoming.

Resources

Primary Sources

- Joyce, Matt. “Hansen Remembered as a man who gave much, but took little.” Cheyenne Tribune Eagle, Oct. 25, 2009, accessed 4/12/12 at http://www.wyomingnews.com/articles/2009/10/25/featured_story/01top_10-25-09.txt

- Justia.com. United States v. Midwest Oil Co. - 236 U.S. 459 (1915) Accessed 4/12/12 at http://supreme.justia.com/cases/federal/us/236/459/case.html

- Leshy, John, Personal e-mail correspondence, February 16, 2012.

- Mineral Management Service: “Summary of mineral revenues distributed to States by the Bureau of Land Management and Minerals Management Service from Federal onshore mineral leases, Fiscal Years 1920-2000.” Accessed 4/12/12 at http://www.onrr.gov/Stats/pdfdocs/DisbAll01.PDF

- Palley, T.A. The Midwest Review, Vol. 1, No. 2, February 1920.

- State of Wyoming. Session Laws of Wyoming, 1921. Cheyenne, WY, 1922, Chapter 51, p. 40.

- “Wyoming Oil Now in Standard’s Hands.” New York Times, Jan. 3, 1921.Accessed 4/12/12 at http://query.nytimes.com/gst/abstract.html?res=F00C11F83F5810738DDDAA0894D9405B818EF1D3

Secondary Sources

- Gray, Brian, “The Mineral Leasing Act of 1920.” Accessed 4/12/12 at http://www.enotes.com/mineral-leasing-act-1920-reference/mineral-leasing-act-1920

- Larson, T.A. History of Wyoming, Lincoln, NE: University of Nebraska Press, 1965, pp. 431-436. Larson died in 2001, thus living to see the Mineral Leasing Act of 1920 become a major contributor to the state’s coffers. Yet Larson explores the act quite sparingly in his History of Wyoming. Still, he manages to hit the important points, like Barlett’s prescient comment about the primacy of Wyoming’s mineral industry over agriculture, p. 432.

- Roberts, Harold D. Salt Creek, Wyoming: the Story of a Great Oil Field. Denver: Midwest Oil Corporation, 1956, p. 157.

- Rosenberg Historical Consultants. Tour Guide: Salt Creek Oil Field, Natrona County, Wyoming. Casper, Wyoming: Natrona County Commission, 2003.

- Shoemaker, Rebecca S. The White Court: justices, rulings, and legacy. Santa Barbara, ABC-CLIO, Inc., 2004, p. 164.

Illustrations

- The photo of Midwest, Wyo. about 1920 is from Wyoming Tales and Trails. Used with thanks.

- The photo of the Supreme Court that heard United States v. Midwest oil shows, seated in the front row from left, justices William R. Day and Joseph McKenna, Chief Justice Edward Douglass White, and justices Oliver Wendell Holmes, Jr. and Horace Lurton—the last of whom died before the court issued its final decision in the case. Standing from left are justices Joseph Lamar, Charles E. Hughes, Willis Van Devanter and Mahlon Pitney. The photo is by Harris & Ewing, Collection of the Supreme Court of the United States. Used with permission and thanks.

- The photos of justices Joseph Lamar and Willis Van Devanter are from the George Grantham Bain Collection at the Library of Congress. Used with thanks.